How to Fix the Euro : Strengthening Economic Governance in Europe

Stephen Pickford, Federico Steinberg a Miguel Otero-Iglesias (Chatham House)

This year euro celebrates fifteen years of its existence. Its introduction was accompanied by high expectations that the Euro would help reinvigorate the European economies. However, after the euro’s relative successes associated with high economic growth in the early years of its existence, the economic and financial crisis hit the entire European Economic and Monetary Union (EMU) in 2007 and raised a number of questions concerning the sustainability of the single currency project. After several years of intense dealing with the manifestations and consequences of the crisis, now it’s the right time to conduct a thorough analysis of the EMU’s main weaknesses and to identify the steps to be undertaken to the fix the euro’s weaknesses.

First of all, such an analysis must come up with correct interpretation of the EMU’s fundamental problems that cannot be confined only to very loose fiscal policy and the lack of regulation and control of the banking sector. Much more attention should also be paid to the shortcomings associated with the structure and management of EMU itself, which for example significantly underestimate the importance of the movement of goods and labor and almost ignore the significant imbalances of payments between the individual members of the eurozone. Although the outbreak of the crisis led to a series of reform initiatives concerning various aspects of the economic policy, these changes can by any means be seen as sufficient.

To ensure the effective functioning of the EMU and the removal of its structural weaknesses, it is necessary to create a fiscal union, which will help uphold the budgetary responsibility of individual states. Meanwhile, the creation of the bank union will provide for a joint supervision of financial institutions while the establishment of the economic union will reduce the differences in the level of innovation and competitiveness of individual euro-zone members. Great emphasis will have to be placed on the establishment of a new central budget authority that will have the power to move funds between Member States in order to facilitate the reduction of structural imbalances. Any deeper economic reform must go hand in hand with political reform. Therefore, it is necessary to view the political union as a necessary precondition for stable, sustainable and more prosperous European economic and monetary union.

(The study can be uploaded here: http://www.chathamhouse.org/publications/papers/view/198575)

Rocky Road to a Level Playing Field in EU-China Investment and Trade Relations

Artur Gradziuk aDamianWnukowski (The Polish Institute for International Affairs)

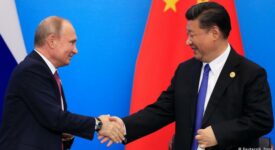

Earlier this year, the EU leaders launched talks with the Chinese President Si Jin-Pching to conclude a bilateral investment protection agreement, also called a Bilateral Investment Treaty (BIT), which would reinforce the importance of the trade relations between both economic powers. During his first visit to Brussels, the Chinese President mentioned that the adoption of the BIT could pave the way for the sealing of a free trade agreement between the EU and China. For the EU, the adoption of the BIT would mean the creation of a bilateral agreement at the EU level and the replacement of all existing 25 BITs between the Member States of the EU and China.

The sealing of a BIT at the EU level would concurrently test the viability of the new common EU policy in the field of international investment. With the adoption of the Lisbon Treaty, this area falls within the exclusive competence of the EU, which means that all new BITs are approved by the European Commission and not the Member States. The EU’s objective now is to integrate the BITs from previous years still binding on Member States to be gradually replaced by the agreements adopted at the EU level. The adoption of the BIT between the EU and China also provides a means to strengthen their strategic partnership, which marked a ten-year anniversary last year.

Both EU and China have shown a keen interest in concluding the BIT. Since the signing of the strategic partnership, both sides have been unable to conclude a significant economic agreement governing bilateral economic relations, which would replace the Agreement on Trade and Cooperation Agreement from 1985. The new agreement could also give the EU better position in the Chinese market, expanding access to the market and reducing stress that recently characterized the EU-China relations. For China’s part, the adoption of the BIT would primarily mean a better access to European know-how and advanced technology.

With the BIT with China, the EU wants to achieve an equality of conditions for current and future European investors. The conditions for market access are unequal and there are a number of barriers that must be removed. This includes the elimination of problems with predictability and transparency connected with doing business in China. It will also be necessary to open the Chinese market to new investment opportunities and to eliminate discriminatory treatment of foreign companies. Unequal conditions can also be seen in specific sectors, such as automotive, engineering, construction, energy and more.

(The study can be uploaded here: http://www.pism.pl/Publications/PISM-Policy-Paper-no-91)

Investment in and the financing of the European Economy

Philippe Maystadt (Robert Schuman Foundation)

The European Union is currently facing a serious investment crisis that could have a major impact on the future of the Member States in economic and social fields. According to the latest data, the investment rate is lower by 16.9 percent compared with 2007. The EU recorded twice as big a drop than the United States or Japan. This unflattering situation is not only due to the financial crisis. The previous imbalance also played an important role, which was caused by over-investment in some sectors of the economy and therefore did not contribute to sustainable growth.

The amount of investment in the European context is limited by three key factors. First, there appears to be a significant reduction in investment returns that vary across states. Secondly, there is uncertainty about the future development of the global economic crisis, the economic policies of some Member States’ governments, and also how to address the banking crisis in the euro area. Thirdly, the EU is experiencing a drastic decline in cross-border capital flows, leading to greater reliance on domestic savings and limited funding opportunities. The restriction of credit proposals is due to the newly adopted regulatory framework that aims at preventing the use of public funds to rescue private businesses. Applications of these new rules sometimes have a negative impact on the investment in EU Member States.

The path out of the investment crisis leads through improved financing for small and medium-sized enterprises, whose biggest problem and dilemma is how to acquire an acceptable bank loan. The solution is to provide a guarantee for individual banks or to secure new financing methods. Another way to overcome the investment crisis is to secure better financing for research and innovation projects. While this is only one of the most vulnerable areas, we should also not forget about better infrastructure funding, which is particularly at risk in times of economic crisis when it is politically acceptable to delay investment rather than to reduce certain social benefits for the electorate. To deal with this conundrum, EU policy-makers should consider redirecting a certain share of financial assets of pension funds and insurance companies to infrastructure projects.

(The study can be uploaded here: http://www.robert-schuman.eu/en/european-issues/0307-investment-in-and-the-financing-of-the-european-economy)